BAB, Inc.: A Bargain to Nosh on, or Just the World's Smallest Dividend Trap?

Activists have dabbled in BABB stock before, but may not necessarily do so again.

BAB, Inc. (OTCMKTS:BABB) may be the closest thing in the U.S. public markets to the restaurant royalty trusts of Canada. BAB, which franchises lesser-known restaurant concepts such as Big Apple Bagels and My Favorite Muffin to independent operators, largely exists to collect royalties, and distribute the after-tax proceeds to investors.

These earnings add up to around $500,000 annually. That may sound small potatoes, but given BABB’s market cap of just $6.1 million, cash payouts are high enough to provide investors with a 7.14% annual forward dividend yield.

However, cash dividends may be the only benefit to owning BABB. Shares have experienced little in the way of price appreciation over the past decade. Chalk this up to a lack of earnings growth.

Admittedly, it’s quite impressive that BAB has managed to produce at least $500,000 or so in annual earnings over the past decade, given how the number of franchisees for both of its restaurant concepts have declined during this time frame.

Still, that factor (declining store count) may call into question the potential for either management, or an outside activist, to unlock potential value with this company.

With this in mind, let’s take a closer look, and see whether there’s merit to buying BABB stock at current prices (around 84 cents per share).

Background

Founded in 1992 as BAB Systems, the company started off with its franchise concept Big Apple Bagels. In 1997, BAB acquired My Favorite Muffin, which by the way was the same year the Seinfeld “Muffin Tops” episode aired, perhaps suggesting BAB bought this concept at the height of the ‘90s Muffins bubble, if there was one.

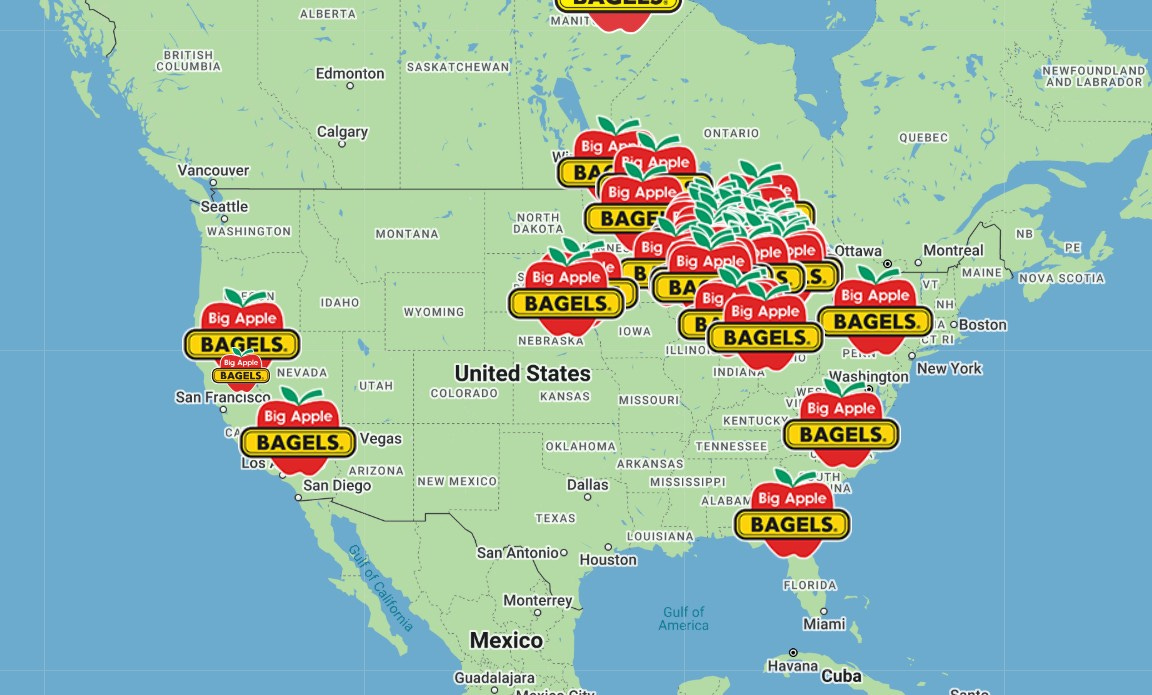

During that decade, BAB also launched its own in-house coffee brand, Brewster’s, and either launched or acquired SweetDuet, a frozen yogurt brand sold at many of its Big Apple Bagel and My Favorite Muffin Locations. As seen from the location maps below, Big Apple Bagel operates in the Midwest, mainly in the states bordering the Chicagoland area (BAB is based in the Chicago suburb of Deerfield, IL).

There aren’t a whole lot of My Favorite Muffin locations, but for informative purposes I will include MFM’s location map as well:

MFM’s locations are all over the U.S., with just 2 out of 8 locations in the vicinity of BAB’s home turf.

Taking a look on OTCMarkets.com, we can see that BABB stock went public in 2000, and while on a split-adjusted basis it has gained nearly 14x, all those gains (and then some) accrued between 2000 and 2005.

That’s when BABB reached its high-water mark of nearly $1.50 per share. In nearly 20 years, the stock has to re-hit this past high. As mentioned earlier, BABB has barely gained over the past decade, although for those holding the stock for the dividend, this is of course a better outcome than what’s usually par for the course with dividend traps: buy, collect a high yield, but experience a steady drop in the value of your investment.

Speaking of dividends, with the exception of a nearly yearlong dividend hiatus during the 2020 Covid lockdowns, BABB has been paying out dividends since 2003.

The company pays out a penny-per-share quarterly dividend, and has historically paid out an annual special dividend as well. In 2024, this dividend came out to 2 cents per share, although in many other years this too has been a penny-per-share dividend.

Recent Developments

Last fiscal year (ending November 2024), earnings came out to $525,200, or 7 cents per share. This represented a 12.4% increase compared to FY2023, but going back to FY2021, prior to the big inflation run-up, BABB reported earnings of $651,122, or 9 cents per share.

Also, as mentioned earlier, BABB has had a longstanding issue with declining store count. A decade ago, the company had 87 franchise units. By 2021, that figure had dropped to 68. Today, that figure stands at just 61.

It’s unclear whether future net franchise unit declines will occur at a similar pace (2-3 unit losses annually), or if they will accelerate in the future.

If the company were successful in keeping unit losses at their current pace, the impact of aggressively maximizing profitability could in theory have a tremendous impact on valuation.

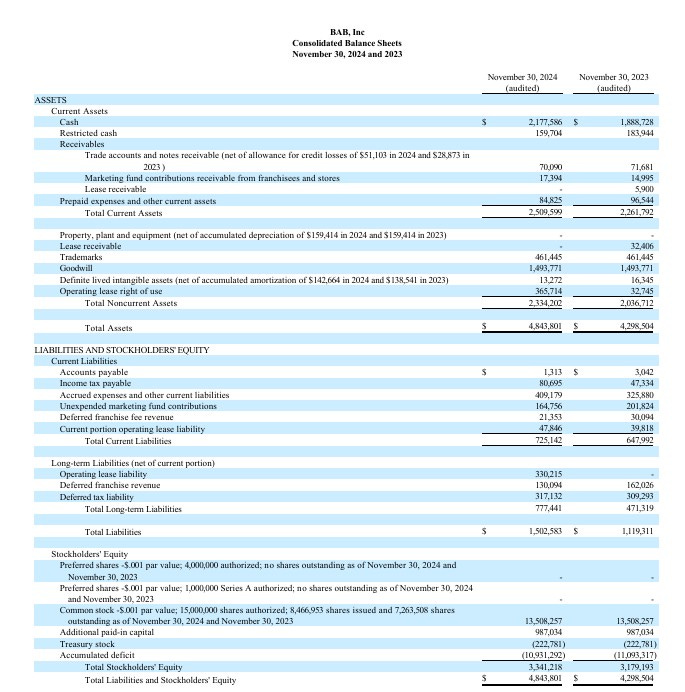

BABB Stock Valuation

At current prices, BABB has a market cap of $6.1 million. Add a $330,215 operating lease liability, and subtract $2.177 million in cash, and the company has an enterprise value of around $4.3 million.

Operating income of $665,294, plus depreciation of $4,123, gives us annual EBITDA of $669,417, which in turn means BABB currently trades at an EV/EBITDA ratio of around 6.3x. This likely represents a fair valuation, given BABB’s lack of earnings growth, plus the uncertainty surrounding its future store count.

If store count stayed constant/continued to drop in a similarly-modest pace, shares could not only hold onto their current value, but would stand to benefit greatly from cost rationalization efforts.

Taking a look at the screenshot of BAB’s annual income statement above, we can see that the company had around $2.88 million in total operating expenses last year. By subtracting the $1.18 million that went towards the marketing fund, we get adjusted operating expenses of around $1.7 million.

$1 million of this figure is for payroll, with more than half this figure representing compensation to the C-suite. $126,441 represents occupancy cost (lease expense for the company’s HQ). A strategic buyer/private equity-backed rollup would likely eliminate most, if not all, of these expenses.

Even if the company were to “maximize efficiency” on its own, perhaps at the insistence of a shareholder activist, BAB could still reduce costs to a point where it would have a significant impact on profitability.

For instance, let’s say BAB downsized its C-suite (by outsourcing General Counsel and CFO duties), sublet its office space (100% remote workforce!), and implemented other cost measures that resulted in slashing overhead by just 40% of overhead ($680,000).

Add that figure to existing EBITDA ($669,417), and we get enhanced EBITDA of around $1.35 million. Slap BABB’s current EBITDA multiple to this figure, and we get a gross valuation of around $8.5 million. Subtract lease liabilities, add back cash, and we get a net valuation of around $10.35 million, or around $1.42 per share, a nearly 70% premium to current prices.

Considering the potential for a strategic buyer to completely consolidate BAB’s overhead into their existing infrastructure, generating additional annualized cost savings, $1.40 per share may just well be what third-party acquirers would be willing to pay for this business.

Why BABB Still Has So Much Untapped Potential

Don’t get me wrong. The “thesis” I’ve laid out above is far from an original idea. At least, based upon the prior instances of activist investors taking positions in this company:

Back in 2013, JCP Investment Partnership accumulated a 13-D level position in BABB. JCP accumulated more shares, paying as much as 86 cents per share, but eventually wound down the position, falling below the 5% reporting threshold in early 2015. BABB’s performance during this time frame suggests that the activist fund, which has since gone after far more famous restaurant companies, gave up on its efforts to control the future destiny of BAB.

Joseph P. Daly, a private investor some may know from his involvement with Butler National Corporation (BUKS), also dabbled in BABB stock during the mid-2010s. The last 13-D amendment filed by Daly is from 2018, reporting share sales that put him below the 13-D threshold. It’s unclear whether he still holds a position, or if eventually exited BABB completely.

In 2020, Camelot Event-Driven Fund, a mutual fund managed by Florida-based asset manager Frank Funds, disclosed ownership in a 479,411 share position in BAB, representing a 6.6% ownership stake. Camelot’s annual report, plus BAB’s latest proxy statement, confirm that Camelot remains a 5% shareholder in BABB.

Speaking of BAB’s latest proxy statement, this document may provide further insight as to why an activist has yet to make headway. CEO Michael Evans owns 19.72% of BAB’s outstanding shares.

Michael Murtaugh, VP and General Counsel, owns a 13.33% interest. While representing just 1/3 ownership of all of BAB’s outstanding shares, this ownership, plus a “shareholder rights plan” (aka poison pill), may have so far been enough to keep activists at bay.

The poison pill, first authorized in 2013, gives shareholders as of May 13, 2013 the right to acquire Preferred Stock that would stymie any efforts from an outside shareholder to acquire more than 15% of the company.

Originally supposed to sunset within 3 years, ever since the board has continued to extend the poison pill’s expiration date. The latest extension, approved in 2023, moved the expiration date to May 2027.

Bottom Line on BABB

As the aforementioned factors dampen BABB’s appeal as an activist or takeover target, BABB stock may be little more than a less-liquid vehicle for capturing a high annual dividend yield.

While it’s not out of the question for BAB’s management to sell the company (given the advanced ages of the C-suite), buying on this factor alone may not be worthwhile, if continued franchise unit declines impact future profitability, weighing on the stock price/future selling price of the company.

BAB could be of interest to an investor looking to build a publicly-traded vehicle. For instance, they could make a deal with BABB’s insiders to acquire their interest, gain control of the business, then maximize profits through aggressive cost-cutting, as well as diversify by investing BAB’s cash flows/borrowing against them to acquire other businesses.

Until such a scenario starts to play out, however, individual investors may want to stick to the sidelines with BABB stock.

DISCLOSURE: As of Publication, The author (Thomas Niel) held a position in BUKS.

DISCLAIMER: I wrote this article myself, and it expresses my own opinions. I am not receiving compensation from BABB or any other entity for writing this article. I have no business relationship with BABB, or any other company referenced.This article is for informational purposes only, and should not be construed as investment advice. Please consult your financial advisor before making any investment decision. Please be aware of the risks associated with trading BABB stock. Do your own due diligence, and caveat emptor.