Precision BioSciences (DTIL): A Deeply Undervalued Biotech With Short-Squeeze Potential

Plenty of unprofitable biotechs trade at a discount to tangible book, but recent newss suggests strong re-rating potential for DTIL stock.

Hat tip to BuySideReport (@buysidereport) for inspiring today’s idea.

At first glance, Precision BioSciences (DTIL) may appear to be your run-of-the-mill small, publicly-traded clinical-stage biotech stock.

Since going public nearly six years ago, the company has stacked up steady losses, and has engaged in heavy shareholder dilution. As a result, DTIL stock has experienced a tremendous decline in value.

Even the fact that DTIL trades at a significant discount to its cash position may not be enough to pique the interest of many seasoned investors. After all, negative enterprise values are par for the course when it comes to small, unprofitable biotechs, given their high anticipated future cash burn.

However, taking a closer look, it’s clear that DTIL may have what it takes for this situation to play out a lot differently than it has in the past. Thanks to a smattering of potential near-term and long-term catalysts, shares may be well-positioned to experience an outsized rebound in price down the road.

Precision BioSciences: Background

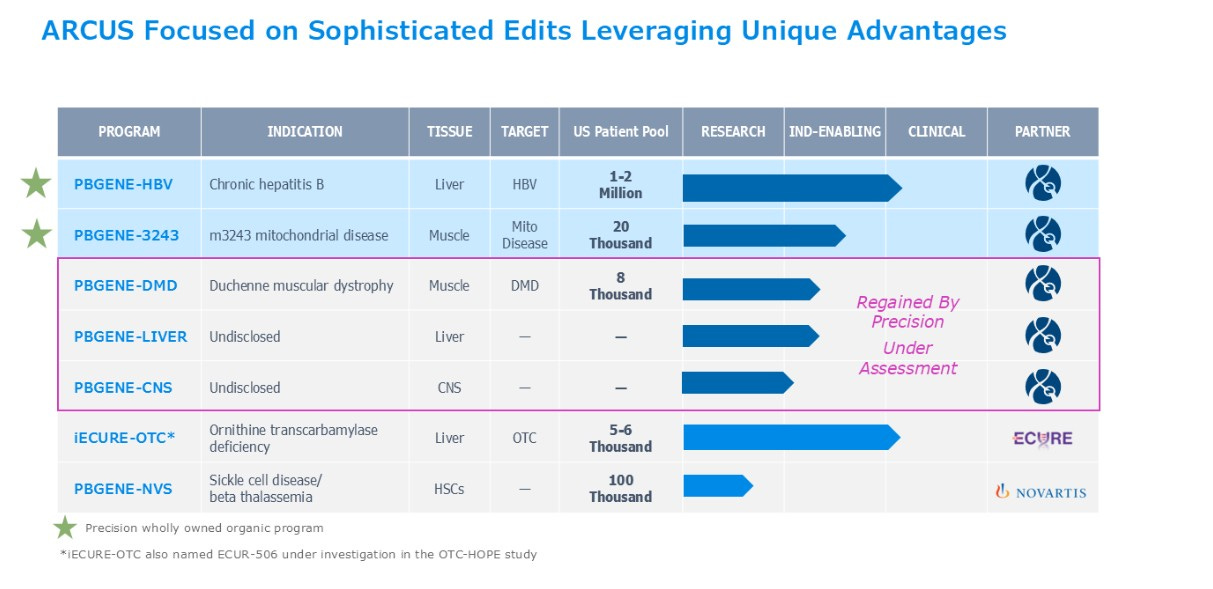

Headquartered in Durham, NC, within the Research Triangle region of North Carolina, Precision BioSciences develops gene therapies, using its proprietary ARCUS in vivo gene editing platform.

Founded in 2006, Precision went public in March 2019, and has been steadily dropping in price ever since. Trading for prices nearing a split-adjusted $590 per share that year, today DTIL stock trades for less than 1% of this high-water mark.

However, while most investors have bailed en masse on DTIL, don’t assume this means those taking a look now should immediately throw it in the “pass” pile.

As discussed in this corporate video, Precision believes that ARCUS is a superior gene editing platform than the more well-known CRISPR gene editing technology. Even as the company has yet to commercialize any products, Precision has thus far built up a promising pipeline, with two of its candidates, including a treatment for chronic hepatitis B now at the clinical stage of their development:

Moreover, since the start of the year, there have been promising developments related to one current drug candidate, as well as one former candidate that DTIL remains eligable to receive back-end milestone compensation and royalites.

First, back on Jan. 10, Precision announced positive trial news about its ECUR-506 candidate, which is part of its iECURE-OTC program in collaboration with iEcure Inc. Per the announcement, this candidate “generated a complete clinicial response in a Phase 1/2 trial for orinthine transcarbamylase (OTC) deficiency, a rare metabolic disorder.”

As for the second development, the specifics are somewhat confusing but nonetheless still material to the DTIL bull case. Back in 2023, Precision sold its CAR-T cell therapy business, including the rights to azer-cel, a cell therapy for the treatment of large B-cell lymphoma, to Australia-based Imugene, in exchange for $21 million in upfront cash and equity, plus eligability for as much as $206 million in milestone payments, as well as future royalties on azel-cel sales.

On Feb. 13, Imugene released positive results from its Phase 1b azer-cel clinical trial, a follow-up to the intial positive results related to this study unveiled last September. In September’s announcement, Imugene revealed that two patients in the cohort receiving azer-cel as part of their treatment achieved a complete response, or a disappearance of all signs of cancer in response to the treatment.

In the Feb. 13 announcement, Imugene announced two additional patients achieved complete response, bringing the complete response total to four out of seven patients in the cohort receiving azer-cel.

Although the market reacted postively to both developments (albeit more moderately to the azer-cel news), it’s not as if either catalyst has become fully baked into DTIL's valuation.

DTIL Stock Valuation

At current prices, Precision BioSciences has a market cap of $40.4 million. That’s an extremely low valuation, even if we compare this just to DTIL’s reported cash position of $110 million, not taking into account the value of DTIL’s pipeline and ARCUS gene editing platform.

Again, it’s not out of the ordinary for a clinical-stage biotech to trade at a heavy discount to cash. However, while the company continues to disclose that it may tap into the company’s existing at-the-market (ATM) facility, as part of its plans to extend cash runway through the second half of 2026, that may not necessarily be an immediate concern.

Based on operating expenses (around $22m-$25m/quarter), the current cash position may prove sufficient to provide cash runway into early 2026. Furthermore, over the next twelve months, the company could obtain additional capital, with no dilutive impact, or at worst, with minimal dilutive impact.

For example, the company could enter a deal similar to last year’s licensing deal with TG Therapeutics (TGTX). In that transaction, TG Therapeutics provided Precision with $15 million in upfront payments, agreed to purchase newly-issued DTIL shares at a premium, as well as made Precision eligible to receive up to $288 million in milestone payments, plus royalties. In exchange, TG Therapeutic received the right to develop azer-cel for use treating non-cancer diseases, such as autoimmune diseases.

This year, there may also be the opportunity for DTIL to monetize its equity stake in iEcure, which is currently listed at a book value of $3.2 million, but could be worth considerably more in the event iEcure goes public, which it might do this year.

That’s not all. An IPO for iEcure, as well as other monetization events, could help to underscore the underlying value of Precision BioSciences, helping to drive a significant move higher for shares. How much higher? If sentiment improves, the market could re-rate Precision on par with other gene therapy companies, like Beam Therapeutics (BEAM) or Intellia Therapeutics (NTLA).

Instead of trading at a discount to book value, BEAM trades for around 3.25x book, while NTLA trades for around 1.06x book. With this, a re-rating of DTIL, to within this valuation range (1.06x to 3.25x book), may be within reach.

With Precision reporting a book value of $8.67 per share as of Sep 30, 2024, that suggests a return to prices ranging around $9.20 to $28 per share.

Additional Catalysts Bolster Near and Long-Term Upside Potential

The aforementioned potential catalysts for Precision BioSciences represent just the tip of the iceberg. Beyond the potential for further iECURE-OTC or Imugene progress or an asset/pipeline monetization event resulting in an eight or nine-figure windfall for DTIL, the total potential value of every opportunity within Precision’s pipeline reach may be in the billions.

As Twitter user BuySide Report has argued, add together all of Precision’s partnershps together, and the total amount of possible milestone payments tops $2 billion. The potential for high single-digit/low double-digit royalties from these drug candidate (if they make it to market) could ultimately provide financial windfalls in the nine-digit range.

It’s also possible that, due to its strong pipeline and the value of its ARCUS platform, a deep-pocketed strategic buyer ends up offering to buy the company at a big premium to current price levels.

If some or all of these catalysts play out, DTIL could eventually climb to level at the upper end of our price target range. Although it may take many quarters/many years for these more substantial potential catalysts to play out, keep in mind that there’s also the potential for a outsized move higher in the near-term.

Even as only a moderately-high level of float (12.7%) has been sold short, recent trading volume has been less 100,000 shares daily. Public float also continues to trend lower.

Over the past month, Lynx1 Capital Management LP, a fund managed by Weston Nichols, who also serves on the board of Crinetics Pharmaceuticals (CRNX), has acquired a 9.9% stake in DTIL. Swiss pharma giant Novartis (NVS) has reported ownership of a 5.4% stake in the company as well.

Put it all together, and it will likely take a short seller quite some time to exit a position. Moreover, if DTIL releases promising results/updates, as part of its upcoming quarterly earnings release pre-market on March 12, this could drive a post-earnings squeeze.

Other clincial trial updates released throughout the year could potentially have the same impact.

Risks/Concerns to Keep in Mind

While it may not take much to drive an outsized move higher for DTIL stock, one can say that the inverse is true as well. A year from now, when the company expects to have full data from the iECURE study, any negative aspect of the data release could drive the next big slide for DTIL.

The same can be said about Imugene’s future data releases for its azer-cel trials. DTIL could also be at risk of big reversal in price, if the company is unable to tap into non-dilutive or less dilutive funding sources, and once again has to raise capital via a secondary offering, or through its at-the-money facility. Shares fell by 30% the last time the company announced its last major secondary offering, back in March 2024.

Bottom Line on DTIL Stock

In case you didn’t know, Precision’s ticker symbol stems from the company’s motto: Dedicated To Improving Life. A laudable goal, and one that Precision BioSciences appears poised to achieve, given the above-mentioned clinical trial results.

As efforts continue to fulfill this goal, the company could make substantial progress towards hitting the commercialization stage. With DTIL stock trading at deep discount prices, any sort of major positive shift in fiscal performance could have a tremendous impact on DTIL.

It goes without saying that biotech stocks are extremely risky. This stock’s relatively lower level of liquidity should be taken into consideration as well, if one is looking to build up a serious position in DTIL stock.